SERVING THE COMMUNITY SINCE 1921

Over the past 100 years, Lake County has witnessed many banks come and go. One has stood the test of time: North Shore Trust and Savings has been Waukegan’s local bank since 1921.

For the past century we have operated with the same philosophy – Put the Customer First. Having strong roots in the area, this comes naturally for us. We have always viewed our customers as friends and neighbors rather than as a transaction. Our employees are here to provide a service rather than sell a product. North Shore Trust tries to create value for our customers by offering exceptional service at a fair price. We take the time to get to know our customers personally: we listen to your needs and wants and work together to find the right solution.

WHAT MAKES US DIFFERENT

There certainly is no shortage of banks and banking apps to choose from these days. Each is competing for your attention, telling you why they are the best. We would like to take a moment to let you know how we are different.

North Shore Trust and Savings was founded in 1921 by community members with the desire to help others achieve the dream of home ownership. Neighbors pooled their savings together in order to make loans. Each depositor was considered a partial owner and held influence over which loans were made. Management remains focused on the long-term needs of the community and our customers.

Our employees take the time to work with customers to ensure each is well-informed about the products and services they are choosing. A successful interaction is one where you leave in a better financial position than when you came, not one where we sell you the most profitable product. It is through this approach that we have built trusting relationships, many of which have spanned multiple generations and led to countless referrals.

In order to ensure North Shore Trust is here for the long-term, management has strategically built a balance sheet that features capital levels which far exceed those required by federal regulation. This financial strength has carried us safely through The Great Depression, several recessions and a financial crisis. North Shore Trust and Savings has one of the highest capital levels in the state of Illinois and has earned Five-Star ratings for Safety and Soundness from Bankrate.com and Bauer Financial.

North Shore Trust and Savings’ focus since 1921 has been home ownership and wealth accumulation for our customers. We continually invest in training our team and updating technology to better serve our customers, and we give back to the communities that support us through civic service and financial literacy programs. If you are visiting us for the first time, WELCOME! To our existing customers, THANK YOU. If you know someone who needs a community bank, please let them know about us. Tell them who we are, and let us show them how we are different.

- 1921

- 1932

- 1950

- 1980

- 1996

- 2004

- 2008

- 2022

-

1921

to start the North Shore Building and Loan Association in an effort to help the community grow. The bank began operating on May 7, 1921, from the front porch of one of the founding families. For the first 15 years, neighbors would gather around the front porch on Saturdays from 1:00 pm – 9:00 pm to socialize and conduct business. Residents of North Chicago’s 10th Street Business District pooled their resources

Residents of North Chicago’s 10th Street Business District pooled their resources -

1932

a mission that stayed true during the Great Depression. Most residents had no extra money to save, and many were in the market to borrow. In 1932, North Shore became the 13th bank to join the Federal Home Loan Bank of Chicago, providing access to lending funds. Business continued to grow, so expansion was necessary. In 1936, the first official North Shore office opened at 1101 Park Avenue in North Chicago, Illinois, providing longer banking hours and more convenience. North Shore Savings and Loan Association was established to help the surrounding community,

North Shore Savings and Loan Association was established to help the surrounding community, -

1950

North Shore Savings focused on supporting its customers and the surrounding community in this time of need. As the war was nearing its end, management realized a new economic and building boom was imminent, and the association would need to evolve and position itself to capitalize on the area’s growth. Since the current office was on a side street, a more prominent location was sought to promote business activity. A new building was constructed in the heart of the Tenth Street business district and opened for business in the spring of 1950. The building debuted with a new name as well – North Shore Savings and Loan. The business district grew, and North Shore Savings flourished. During the Great Depression and World War II,

During the Great Depression and World War II, -

1980

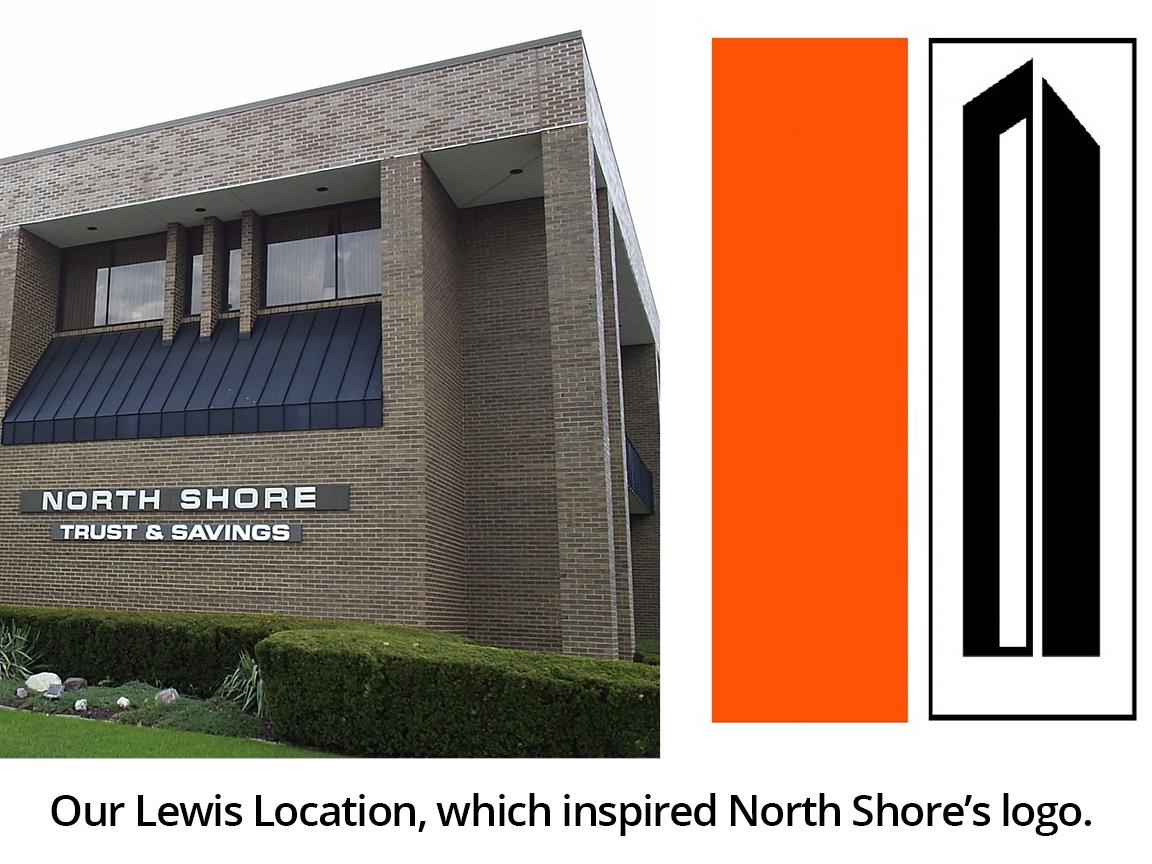

North Shore Trust and Savings saw exponential growth throughout the ‘70s and ’80s.The customer base expanded well beyond North Chicago and Waukegan to encompass all of Lake County, IL. On December 13, 1971, a newly constructed corporate headquarters located at 700 South Lewis Avenue opened to accommodate growth. Hours were extended through the innovative use of a quick-service walk-up window. Checking and Retirement accounts were added to the product menu, while services expanded to include electronic direct deposits, traveler’s checks, and money orders. Although North Shore Trust was thriving, the financial industry itself would take a hit during the savings and loan financial crisis of the 1980s. In the face of such adversity, North Shore remained resilient due to its strong capital, loyal customers, and dedicated staff—attributes that remain the backbone of North Shore today.

North Shore Trust and Savings saw exponential growth throughout the ‘70s and ’80s.The customer base expanded well beyond North Chicago and Waukegan to encompass all of Lake County, IL. On December 13, 1971, a newly constructed corporate headquarters located at 700 South Lewis Avenue opened to accommodate growth. Hours were extended through the innovative use of a quick-service walk-up window. Checking and Retirement accounts were added to the product menu, while services expanded to include electronic direct deposits, traveler’s checks, and money orders. Although North Shore Trust was thriving, the financial industry itself would take a hit during the savings and loan financial crisis of the 1980s. In the face of such adversity, North Shore remained resilient due to its strong capital, loyal customers, and dedicated staff—attributes that remain the backbone of North Shore today. -

1996

with the opening of a second office located on the Northwest side of Waukegan. The Green Bay Rd office was an instant success and continues to be one of the most heavily utilized facilities. The new accounts generated from the new office quickly pushed the Bank’s assets above $250 million. North Shore Trust and Savings had grown to be one of the ten largest savings banks in the Chicago market. More importantly, North Shore Trust remained one of the safest banks in the Chicago market, with four times required core capital and six times required risk-based capital levels. North Shore Trust celebrated its 75th anniversary in 1996

North Shore Trust celebrated its 75th anniversary in 1996 -

2004

The location in Lindenhurst was chosen to service the growing population of western Lake County. The facility was designed to be a full-service retail branch on one half and to house the expanding mortgage department on the other. The early 2000s was also the beginning of a digital revolution for the bank. Technology was implemented to greatly improve the efficiency of daily operations. ATMs were upgraded to accept deposits, and a new website with online enhanced banking features was launched. North Shore Trust and Savings opened its third location in 2004.

North Shore Trust and Savings opened its third location in 2004. -

2008

Housing prices fell rapidly, and borrowers began to default on loans. While this caught many banks off guard, ultimately leading to a record number of bank failures, North Shore Trust and Savings remained a Safe, Sound, and Secure financial institution throughout. Years of conservative management and strong underwriting standards lead to minimal losses. North Shore Trust’s excess capital reserves allowed the bank to work with borrowers and help see them through this difficult time. During these challenging times, North Shore Trust showed itself to be a vested member of the communities we serve.The Great Recession jolted the economy in 2008.

-

2022

and begins listing on the NASDAQ. Customers of the Bank purchased all available shares. Demand was so strong, that the Bank had to increase the number of shares sold in the offer to the regulatory limit. A percentage of the shares sold were set aside in order to establish the NSTS Charitable Foundation. The foundation will continue the Banks tradition of giving back to the community and supporting Financial Literacy and Home Ownership initiatives.North Shore Trust and Savings successfully completes a mutual-to-stock conversion...

COMMITTED TO YOU AND COMMITTED TO THE COMMUNITY

Since 1921, North Shore Trust has invested in and financed what matters to Waukegan and the surrounding communities. We have helped countless families finance their first home, build their dream home, and save for retirement along the way. We work hard to develop unique loan programs that will satisfy the evolving needs of the community. We strive to deliver all of the modern-day technology in order to provide the convenience you desire. We take pride in being part of the fabric of the community and offering services that help local people and families prosper.

The Great Recession jolted the economy in 2008.

The Great Recession jolted the economy in 2008. North Shore Trust and Savings successfully completes a mutual-to-stock conversion...

North Shore Trust and Savings successfully completes a mutual-to-stock conversion...